Auto-Closeout

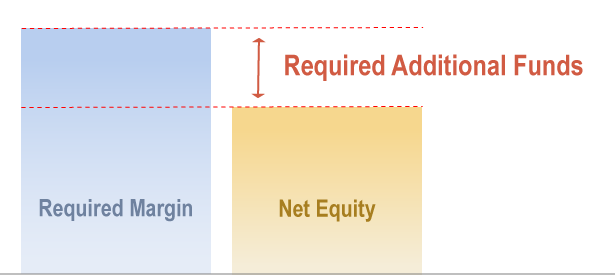

When the net equity of the trading account is lower than the auto-closeout level, ALL your positions will be closed out automatically and all your pending orders will be cancelled to limit your trading risk.

| Triggering Condition | Margin Ratio falls below 30%(i.e. below 1.5% margin) (Margin Ratio = Net Equity ÷ Required Margin × 100) |

|---|

Example

Assuming net equity is HK$6,000, buy 1 lot of EUR/USD at the exchange rate of 1.08096, and the required margin is HK$4,204.93 (based on the USD/HKD exchange rate of 7.78). When the EUR/USD position falls to 1.01912, the account will suffer a loss of HK$4,811.15, and the net equity of the account will drop to HK$1,188.85. At this time, when the system monitors* that the margin ratio drops below 30%, auto-closeout will be triggered.

The calculation formula for this example is as follows:

Margin ratio = net equity ÷ required margin × 10029.9 = (6,000+ floating profit and loss) ÷ required margin × 100

29.9 = (6,000 + (1.01912-1.08096) x 10000 x 7.78 )÷(1.01912 x 10000 x 7.78 x 0.05) x 100

IMPORTANT TO KNOW

For your protection, Auto-Closeout is an automatic margin management feature built within our trading platforms to minimise the probability of losing more than the amount of cash collateral available in your account. Although this is a unique feature to help limit the extent of your trading losses, it does not guarantee that your losses will be limited to the amount of funds you have deposited in your account.

Our system monitors all clients' trading account every 30 seconds or longer (“checking point"). Auto-Closeout process will be triggered if client's net equity falls below 1.5% of open position value in HKD (margin ratio 30%) at the checking point. This process is not to guarantee that client's position is liquidated as near as the 1.5%. In a fast-moving market, prices may move dramatically against your favour and it may take some time for the system to complete the liquidation process, you may incur greater losses or lost profits as a result. There may also be a slight time difference before the system could trigger the Auto-Closeout after your account margin ratio has fallen below 30%

Maintenance Margin Level (Margin Call)

During the trading hours on every trading days, when the margin ratio falls below the Maintenance Margin Level, margin call notification will be triggered*

No new orders can be initiated and fund withdrawal is restricted until the margin ratio restores to the Initial (Required) Margin Level.

| Triggering Condition | Margin Ratio falls below 60% (i.e. below 3% margin) at anytime of each trading day (Margin Ratio = Net Equity ÷ Required Margin × 100) |

|---|

Example

Assuming net equity is HK$6,000, buy 1 lot of EUR/USD at the exchange rate of 1.08096, and the required margin is HK$4,202.9 (based on the USD/HKD exchange rate of 7.78). When the EUR/USD position falls to 1.03488, the account will suffer a loss of HK$3,585.0, and the net equity of the account will drop to HK$2415.0. The margin ratio has dropped below 60%, margin call will be triggered*.

The calculation formula for this example is as follows:

Margin ratio = net equity ÷ required margin × 10059.9 = (6,000+ floating profit and loss) ÷ required margin × 100

59.9 = (6,000 + (1.03488-1.08096) x 10000 x 7.78 ÷(1.03488 x 10000 x 7.78 x 0.05) x 100

*Frequency of margin calls:

(1) When the Margin Ratio of an account fails to meet the Maintenance Margin level at market open or during any trading hours, Z.com Forex will issue first margin call email on a Best effort

basis.

(2) If the Margin Ratio moves below the Maintenance Margin level multiple times or remains below the Maintenance Margin level during the same trading day, Z.com will issue one margin call email every two hours starting

from market opening (e.g. 8:00 a.m., 10:00 a.m. etc).

| Ways to Meet Margin Call |

|---|

After the margin call notification is issued, you must restore the margin ratio to the Initial (Required) Margin Level as soon as possible by the following methods:

|

IMPORTANT TO KNOW

Even if market condition moves in your favour whereby net equity exceeds the Maintenance Margin Level, you are still required to restore the margin ratio to the Initial (Required) Margin Level.

After the insufficient margin has been restored, it may take some time for the system to remove the restrictions imposed on your affected account.

Alerts

When auto-closeout or margin call has been triggered, you will be notified through your trading account and email alerts will be sent to you.

| Alert Type | Condition |

|---|---|

| Auto-Closeout | When net equity falls below Auto-Closeout Level (Margin Ratio falls below 30% or Margin falls below 1.5%) |

| Margin Call | When net equity falls below Maintenance Margin Level (Margin Ratio falls below 60% or Margin falls below 3% at anytime during the trading day) |

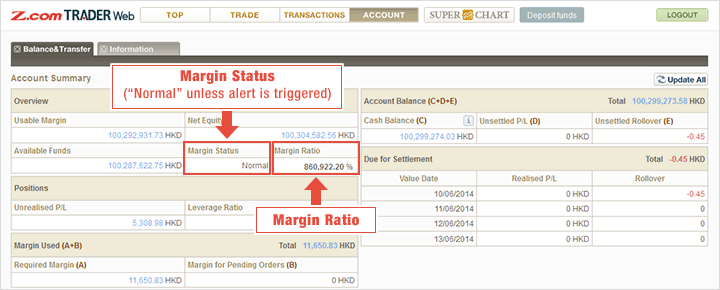

You may view your current Margin Ratio and other account status by logging in to your account and go to Account > Balance & Transfer.