Did You Know You Can Earn

Interest While Trading FX?

Earn passive income before interest rates come down!

As of 13th Nov 2025, wide interest rate differences still remain:

Higher yielding currencies include USD: 4.00%, GBP: 4.00%, EUR: 2.00%, and AUD: 3.60%

Lower yielding currencies include JPY: 0.5%, and CHF: 0%

Z.com Forex offers highly competitive rollover interest rates to clients, which, when combined with leveraged trading, can enhance the potential returns for forex investors holding positions overnight.

Refer to the information on this page to understand the characteristics of rollover interest and to view recent average interest rates as well as totals.

top ten overnight interest in the past 30 days

| Currency Pair | Buy/Sell | Average Daily Interest (HKD)+ | Total Interest (HKD) |

|---|

+ Average daily interest is calculated by dividing the total interest by the number of days. If the data date includes a Wednesday, "3-Day" overnight interest will be shown as interest for the weekend settlement.

The data above are for reference only. The actual interest may differ. Please refer to your trading account for the actual rates.

Distinct Characteristics of FX Trading

![]()

Hold High Interest Rate Currencies and Earn Daily

Generate extra income in addition to your FX trading gains

![]()

Buy and Sell Anytime

High flexibility with no fixed commitment period

![]()

Daily Rates Open and Transparent

Ultra competitive rollover rates. Historical rates available

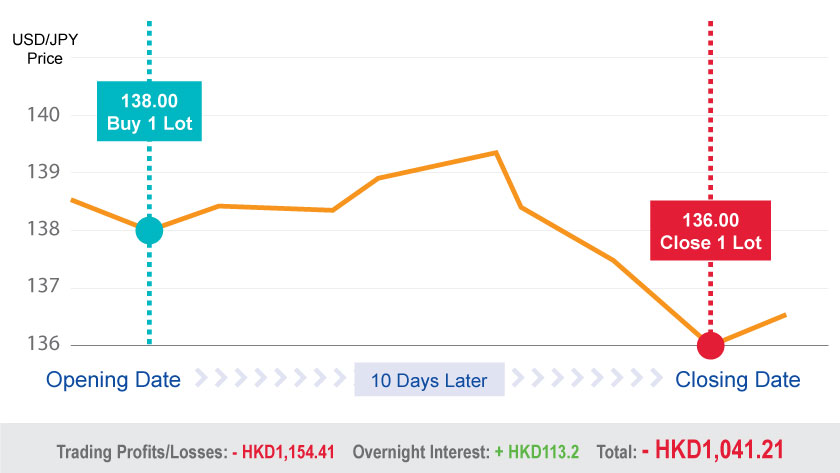

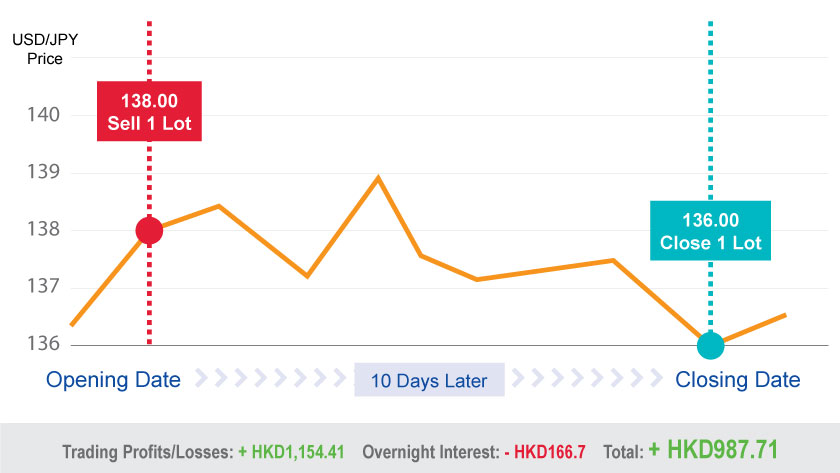

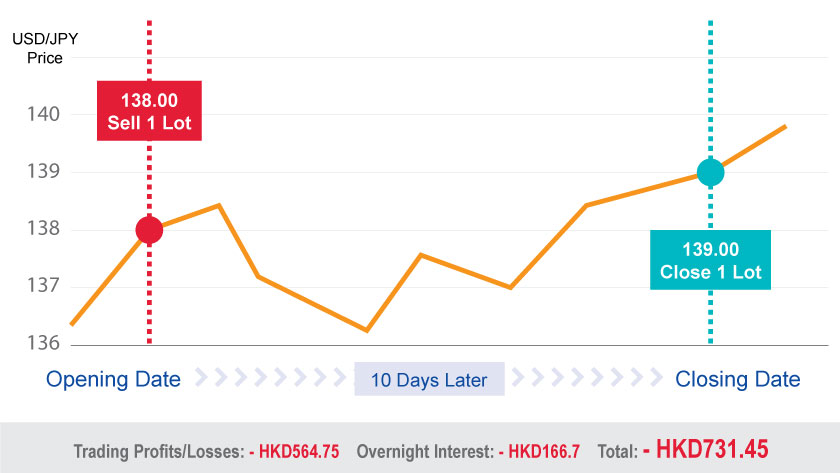

Profits and Losses from High Interest Rate Currencies Explained

*The data below are for reference only. The USD/HKD exchange rate is fixed at 7.85 for illustrative purposes, and the actual rates may differ. Please refer to your trading account for the actual rates.

Tips on Overnight Interest

How is a High Overnight Interest Rate Generated?

- As of 13th Nov 2025, wide interest rate differences still remain:

- Higher yielding currencies include USD: 4.00%, GBP: 4.00%, EUR: 2.00%, and AUD: 3.60%

- Lower yielding currencies include JPY: 0.5%, and CHF: 0%

- The USD/JPY and the USD/CHF are the two currency pairs with the largest interest rate differentials among major currency pairs.

- Buying USD/JPY is conceptually equivalent to borrowing Japanese yen at a low interest rate and then buying U.S. dollars with a higher yield, thus profiting from the interest rate differential. In recent years, the interest rate gap between the U.S. and Japan has widened significantly, further enhancing the appeal of such carry trades. Buying USD/CHF follows the same principle, representing a typical strategy of financing in a low-interest-rate currency and investing in high-yield assets.

How to Earn Overnight Interests?

- Overnight interests will be generated by holding positions overnight at 6:00 a.m. Hong Kong Time (New York Winter Time) or 5 a.m. Hong Kong Time (New York Summer Time), and will be reflected in the account balance automatically (more details)

For open positions held overnight through Wednesday's Trading Close, "3-Day" overnight interest will be realized in order to account for the settlement of trades through the weekend period. - You may earn interest by buying a relatively high interest rate currency. Conversely, you will need to pay interest for holding a relatively low interest rate currency

How to Check the Overnight Interests?

- The Rollover Calendar, showing the historical rollover price provided by Z.com Forex

https://forex.z.com/hk/en/forex_trading/rollover_calendar.html

The Pros and Cons of Using Leverage In Foreign Exchange Trading

- Foreign exchange involves leverage (max. 20 times as specified by the SFC). All interest rate effects, along with changes in the prices, will be magnified

- High flexibility with no fixed commitment period

- Please be aware of the possibility of trading losses incurred while holding positions overnight to earn interest rates

Calculate the Expected Return

Get the following data through the Simulated Calculator:

Required Margin

Required margin for opening new orders

Maximum Trade Lots

The maximum lots you can open according to your deposit amount

The Value of Pips

The value of pips converted to HKD

Profit & Loss

Simulate the profit or loss from closing the position

Overnight Interest

Calculate the total interest income/expense

- The simulated result is for reference only, the simulated calculator may be slightly different from the real situation, and the real account shall prevail

- The interest rate is calculated by the average interest rates for the past 30 days, and may different from the actual rates. Please refer to your trading account for the actual rates.

- Only applicable to USD related currency pairs

Simulated Calculator

-

所需保證金: -

| 賣出 | 買入 | 點差 | 每點價值 |

|---|---|---|---|

| - | - | - | - |

| 存入金額 | 貨幣對 | 買賣方向 | 交易手數 |

|---|---|---|---|

| - | - | - | - |

| 平倉價(如有) | |||

| - | - | ||

| 槓桿比率 | 維持保證金水平 | 自動平倉水平 |

|---|---|---|

| - | - | - |

計算後預期盈虧: -

Such Information does not constitute an invitation or offer by Z.com Forex, or represent the price at which Z.com Forex would be willing to offer and does not constitute any advice or recommendation to conclude any transaction.

No statement, representation or warranty, express or implied, is given by Z.com Forex as to the information's accuracy, completeness or appropriateness for use in any particular circumstances. Z.com will not liable for any errors or omissions for the Information provided, nor for any damages or losses arising from any actions taken in reliance on the Information provided.