What is Margin?

Margin refers to the cash collateral required to enter into positions larger than your actual account balance in leveraged forex trading. In forex trading, you can easily leverage the funds in your account based on the margin requirements for a much greater investing market effect. Metaphorically, the term "leverage" also means that you can move a heavy object with little effort required.

The higher the leverage, the lower the margin capital required. By leveraging your funds, if the market moves in favour of your position, you can take advantage of small market movements to potentially generate large profits relative to the amount invested. Conversely, increasing leverage increases risk.

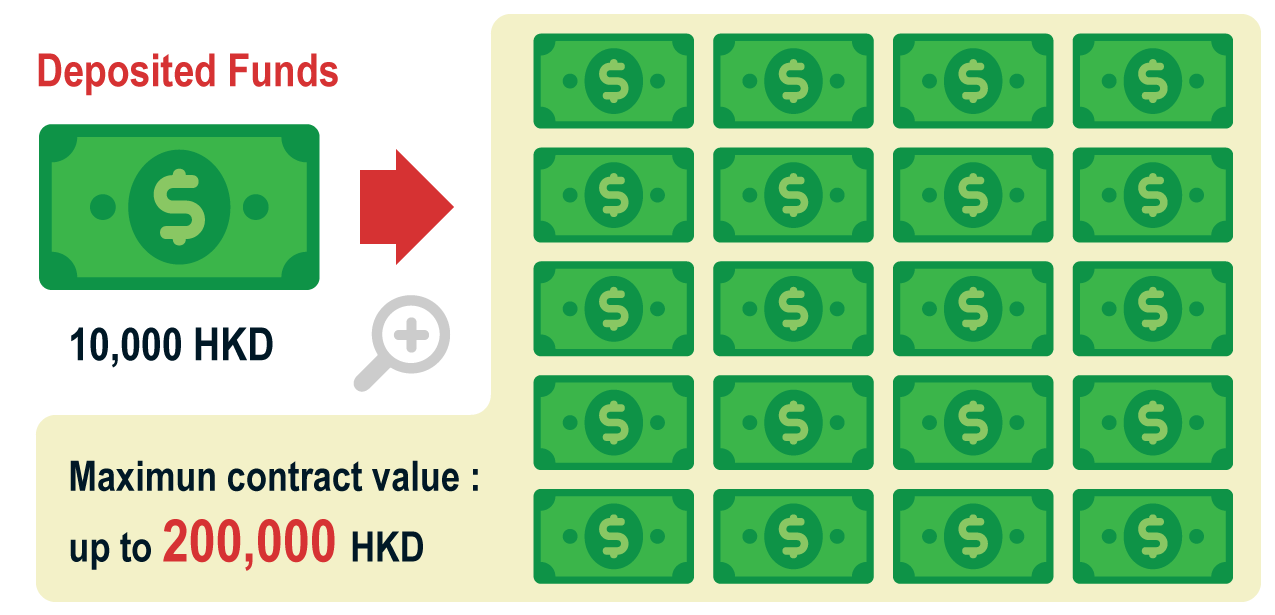

All funds in the trading account are regarded as margin collateral and Z.com Forex offers a maximum leverage of 20:1. With an account leverage of 20:1, it simply means that you can trade up to 20 times with your current amount of funds.

What is Required Margin?

Required Margin refers to the amount of margin required to maintain any pending orders and outstanding positions. All pending new orders and open positions are required to be fully (100%) margined at all times.

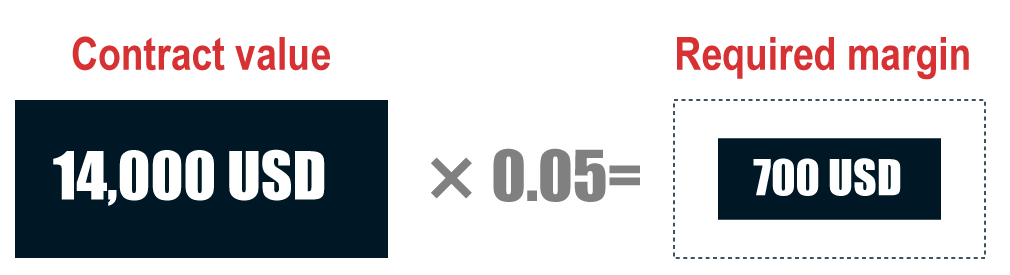

Z.com Forex requires a minimum margin of 5% (or maximum leverage of 20:1) of currency contract value in HKD.

EXAMPLE:

If you open a trade of 1 lot EUR/USD at the exchange rate of 1.40000, the required margin would be 700 USD (5% of currency contract value, 10,000 EUR*1.4*5%). Given if the conversion rate USD/HKD is 7.75, the required margin would be 5,425 HKD for the trade.

Required funds to open 1 lot EUR/USD:

What is Margin Ratio?

Margin Ratio (in %) measures the availability of account net equity to maintain the required margin. The higher the margin ratio is maintained, the lower the account leverage will be. To reduce leverage, you can either: add funds into your trading account; or reduce your open positions.

Calculating Margin Ratio: Net Equity ÷ Required Margin × 100

EXAMPLE:

If you had funded your account with 10,000 HKD and opened a new trade of 1 lot EUR/USD at the exchange rate of 1.40000, then your margin ratio stands at around 184%.

Margin Ratio and Leverage

| Margin Ratio(in %) | Leverage |

|---|---|

| 2,000% | 1 : 1 |

| 1,000% | 2 : 1 |

| 500% | 4 : 1 |

| 200% | 10:1 |

| Below 100% | Exceeds 20 : 1 - No new positions will be allowed. |

| Below 60% | Margin call will be triggered and you will be called upon to top up the insufficient margin. |

| Below 30% | Auto-Closeout will be triggered. (i.e., all your existing positions will be closed out automatically.) |